We can use LIBOR as an example. To make the conversion simply multiply the bond spread percentage by 100.

:max_bytes(150000):strip_icc()/CorporateBonds_CreditRisk22-8c12f1dbc1494f28b3629d456fb4fa63.png)

Corporate Bonds An Introduction To Credit Risk

The midpoint of the foreign exchange spread refers to the theoretical price at which there would be a trade.

How is g spread calculated. The GPA Calculator spreadsheet should be pretty intuitive and some instructions are included at the top of the worksheet. What Is A Spread. A team with a good record will generally be favored over a team with a bad record and therefore the point spread will be larger.

It can be calculated by adding the ask and bid prices and then dividing the sum by two. Second calculate the dB value. Therefore the G spread is 740 -.

In the Course History worksheet you can include additional semesters by copying the set of rows for one of the semesters and insertingpasting the set of rows at the bottomThe formulas in the spreadsheet are designed specifically for making this process. A basis point is 1100 of a percentage point. Therefore the 22k gold coins and products stamped with 916 seals.

Types of Spread. Y c yield on the non-treasury bond. Its calculated by dividing the consumer price index CPI at the time you sold your property by the CPI at the time you bought the property rounded to three decimal places.

Efficiency is calculated using the following formula. G-spread or nominal spread is the spread over the exact interpolated point on the Treasury curve. The spread is calculated iteratively.

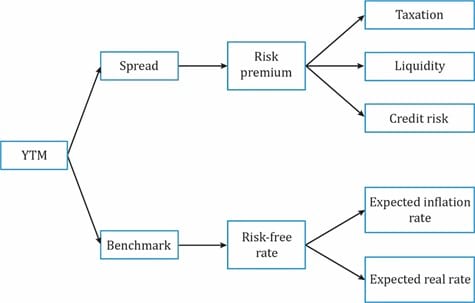

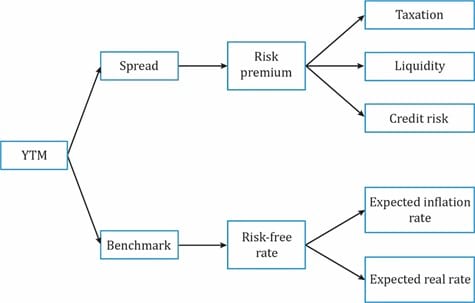

A G-spread is the spread over or under a government bond rate and an I-spread is the spread over or under an interest rate swap rate. Range Spread Maximum less Minimum Maximum. Look at the record of the two teams playing the game.

If the I-spread increases the credit risk also rises. Formula It can be express as a percentage. First click on cell G5 to the right of our existing data.

The calculated value is 041 dB. The 10-year Treasury bond 6 coupon rate has a YTM of 600. The spread over or under a government bond rate also known as the nominal spread.

Here are the secrets to winning forex trading that will enable you to master the complexities of the forex market. Many professionals use basis points to assess bond spreads. G-spread Y c Y g.

You would then add that number to your initial cost price to get your inflation-adjusted purchase price then subtract that amount from your sale price. Your Number Set Input. The I-spread stands for interpolated spread.

For example suppose a 10-year 8-coupon bond is selling at 10419 yielding 740. The Z-spread of a bond is the number of basis points bp or 001 that one needs to add to the Treasury yield curve or technically to Treasury forward rates so that the NPV of the bond cash flows using the adjusted yield curve equals the market price of the bond including accrued interest. The definition of dB is also provided Third calculate the slope m of the segment between the frequencies F L and F H.

Formula It can also be express as a ratio. Enter the numbers separated by comma Eg. Type in the following formula.

A G-spread or an I-spread can be based on a specific benchmark rate or on a rate interpolated from the benchmark yield curve. The following algorithmic calculation tool makes it easy to quickly discover the mean variance SD of a data set. Popular Answers 1 Calculate the number of bacteria CFU per milliliter or gram of sample by dividing the number of colonies by the dilution factor The number of colonies per ml reported should.

Now lets do the percent calculation starting with the percent change in the total number of homicides row 5. Since government bonds eg US Treasury securities are considered risk-free securities swap spreads typically reflect the risk levels perceived by the parties involved in a swap agreement. An OIS is a fixed-floating interest rate swap whereby the floating rate is based on a return calculated from a daily compounded interest investment.

It is the measure of the spread of numbers in a data set from its mean value and can be represented using the sigma symbol σ. Transformation efficiency Total number of cells growing on the agar plate Amount of DNA spread on the agar plate in g Therefole before you can calculate the efficiency of your transfoimation you will need two pieces of information. Range Spread Maximum less Minimum X 100 Maximum.

G-Spread corporate bonds yield government bonds yield. If I have a corporate bond maturing June 15 2018 and it is yielding 3 and it is quoted over the 5-year Treasury yielding 1 and maturing on May 31 2017 then the corporate bond has a. The range spread percentage is a percentage calculated by dividing the range spread for a given pay range by the minimum for that pay range.

Swap Spread Swap Spread Swap spread is the difference between the swap rate the rate of the fixed leg of a swap and the yield on the government bond with a similar maturity. Its formula for calculation of karat is Karat24. The forex spread is the difference between the exchange rate that a forex broker sells a currency and the rate at which the broker buys the currency.

For F L 20Hz ASD L 10 g 2 Hz while ASD H 11 g 2 Hz. We can calculate the G-spread by using the following formula. Y g yield on the government bond of the same maturity.

A Z-spread zero-volatility spread is based on the entire benchmark spot curve. It shows the difference between a bonds yield and a benchmark curve. Dividing the number of.

In our spreadsheet on murder weapons we can calculate how much each weapon increased or decreased between 2010 to 2014. G-spread nominal spread is the difference between the yield on Treasury Bonds and the yield on corporate bonds of the same maturity. Eg 22k gold can be calculated like 2224 0916 91 pure gold which is also called 916 gold.

This spread is constructed by taking an IBOR for a particular tenor typically 3 months and subtracting from it the fixed rate associated with an overnight indexed swap OIS of the same tenor. The record is one of the biggest indicators in determining the point spread. Interpolated spread I-spread is the difference between a bonds yield and the swap rate.

Spread Betting What Is It How Does It Work Ig Uk

Introduction To Fixed Income Valuation Ift World

Spread Betting What Is It How Does It Work Ig Uk