Normal GFR varies according to age sex and body size and declines with age. How is the Pooled Cost of Funds Calculated.

Future Value Of A Growing Annuity Calculator Tvmschools Annuity Calculator Calculator Annuity

While the interest rate is calculated monthly TSP does publish a Daily Share Price.

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_Oct_2020-01-7b25f37332ff434f9bc3794782fe38fe.jpg)

How is g fund rate calculated. Often referred to as G the sustainable growth rate can be calculated by multiplying a companys earnings retention rate by its return on equity. The funding rate of each contract is calculated based on its corresponding Initial Margin Ratio and Maintenance Margin Ratio at the maximum leverage level. Treasury securities on the last day of the previous month.

Treasury securities specially issued to the TSP. This is the formula to calculate GPF Interest. Read more GDP Growth rate foreign exchange rate economy etc.

Government and the G Fund doesnt have any credit or default risk. G Fund interest represents the weighted average yield of all outstanding Treasury notes and bonds with 4 or more years to maturity. We are given below the ending.

The side of the market benefitting from the funding rate is determined by the difference between the contract price and the price of the underlying asset. So in other words the T-bill offers a return on investment of 124052 but since you held it for 91 days you will enjoy this return on a. Glomerular filtration rate GFR is the best overall index of kidney function.

To determine the combined cost divide the balance sheet into different categories of specific interest-bearing assets. Yield Discount Value Bond Price 365number of days to maturity 397 36591 003094010989. Stock fund CAGR 15 34852 10 000 1 5 1 100 895 textStock fund CAGR left frac 1534852 10000 right frac15-1 times 100 895 Stock fund.

Treasury securities with 4 or more years to maturity. GP Fund Interest Rate of Subscription x 650 Opening Balance x Rate of Interest. For Initial Margin Ratio and Maintenance Margin Ratio please refer to Leverage and Margin of USDT Futures Contracts for more detail.

Top ten holdings As of 12312020. Payment of principal and interest is guaranteed by the US. The Morningstar Rating TM for funds often called the star rating is a purely quantitative backward-looking measure of a funds past performance measured from one to five stars.

The initial Funding Rate is calculated based on the 8-Hour Interest Rate and Premium Index. The National Kidney Foundation recommends using the CKD-EPI Creatinine Equation 2021 to estimate GFR. ROE combines the income statement and the balance sheet as the net income or profit is compared to the shareholders equity.

Treasury as the weighted average yield of approximately 153 US. This also applies to some motorhomes. The G Fund rate is calculated by the US.

The Fund ESG Rating is calculated as a direct mapping of Fund ESG Quality Score to letter rating categories. Use the following data for the calculation of the growth rate. Total of monthly interest bearing GPF balance12 interest rate100 Note this formula for academic interest but never do your GPF interest calculation manually any more as we have provided this easy to use online GPF interest calculation tool.

The interest paid by the G Fund is set and is recalculated every month to the average rate of return of US. It is calculated by dividing the difference between two Consumer Price IndexesCPI by previous CPI and multiplying it by 100. Funding Basis Funding Rate Time until Funding Funding Interval Traders could check the Premium Index at Contract Specifications and the corresponding historical data at the index page.

Appearance of overlap in the score ranges is due to rounding. The G Fund rate is calculated by the US. Youll pay a rate based on a vehicles CO2 emissions the first time its registered.

The G Fund interest rate calculation is based on the weighted average yield of all outstanding Treasury notes and bonds with four or more years to maturity. Treasury securities on the last day of the previous month. The combined cost of funds takes into account the assets and liabilities of the organization as a whole.

The yield of the security has a weight in the G Fund rate calculation based on the amount outstanding. 13 rows The rate is calculated monthly based on the average yield of all US. Although the G Fund reports a Daily Share Price the interest rate is calculated monthly based on the last day of the previous month.

After the final calculation a GP Fund slip is issued to the related employee. How funding rates work. Treasury as the weighted average yield of approximately 153 US.

You can yourself calculate this amount of interest by using this formula. Treasury securities on the last day of the previous month. The G Fund rate is calculated by the US.

The assets are then compared with the corresponding interest-bearing liabilities. Yet it is a short-term security. Funding rates influence the price of perpetual swap contracts by penalizing or rewarding traders depending on the nature of their position long or short.

Treasury as the weighted average yield of approximately 130 US. The risk-free rate of return Risk-free Rate Of Return A risk-free rate is the minimum rate of return expected on investment with zero risks by the investor. So the calculation of growth rate can be done as follows.

GP Fund Interest Amount Formula. By law the G Fund must be invested in nonmarketable US. In effect the G Fund is a counter-weight to the TSP stock funds in an investment portfolio.

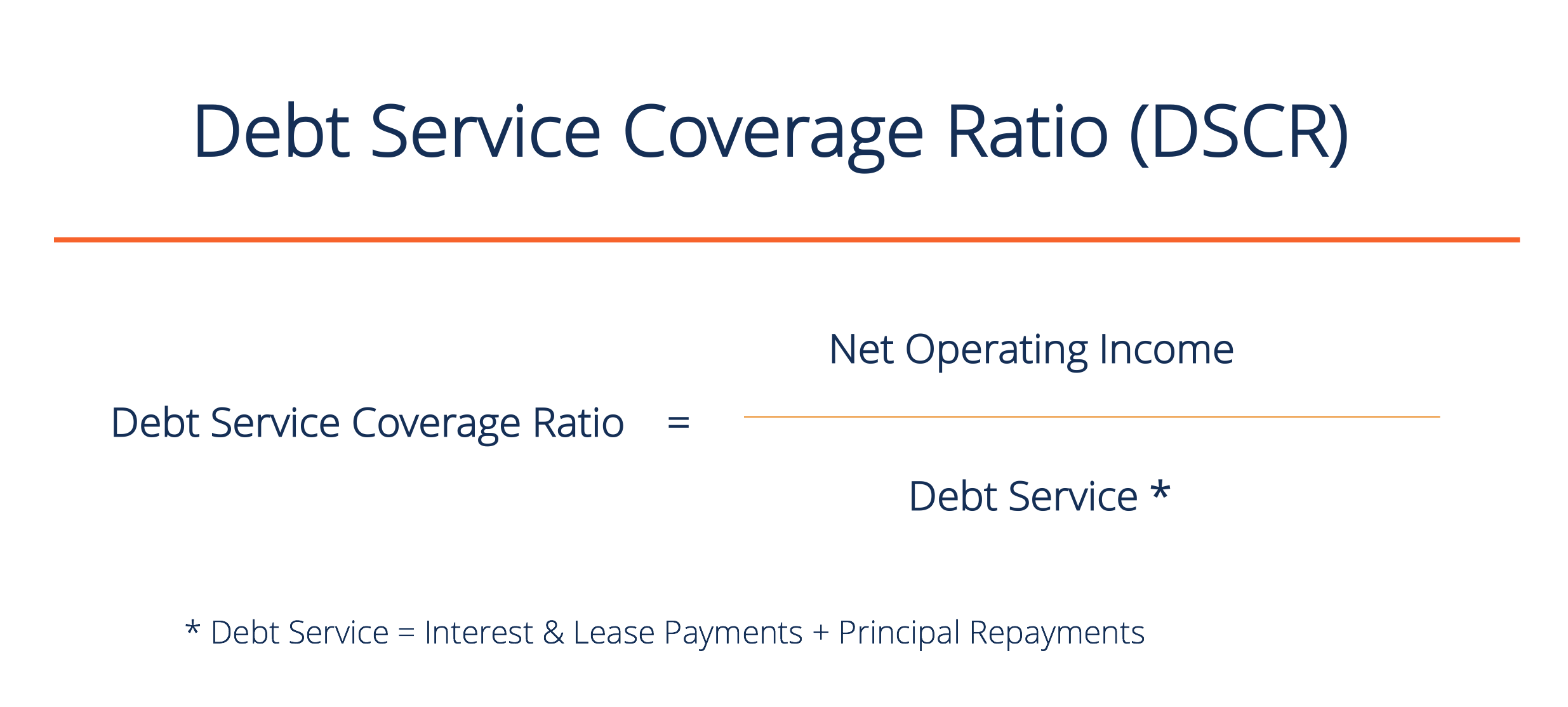

Calculate The Debt Service Coverage Ratio Examples With Solutions

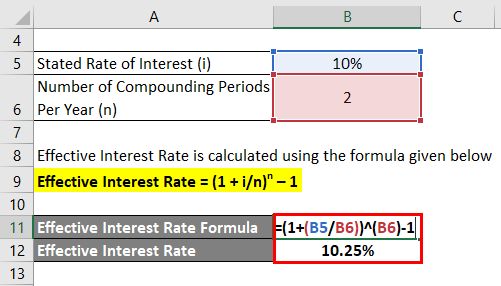

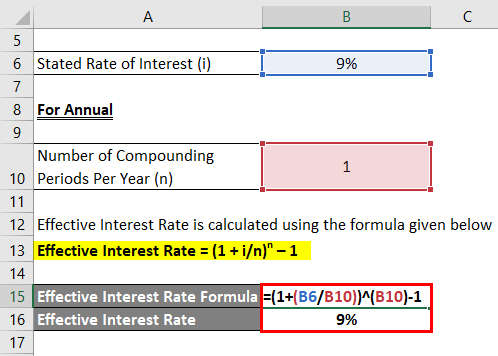

Effective Interest Rate Formula Calculator With Excel Template

:max_bytes(150000):strip_icc()/dotdash_Final_Inflation_Adjusted_Return_Nov_2020-01-c53e0ae26e8f404fb1ce91a9127cbd3b.jpg)

Inflation Adjusted Return Definition

How To Calculate Average Annual Growth Rate Aagr In Excel

Effective Interest Rate Formula Calculator With Excel Template